Rikkei Finance is a Metaverse DeFi Protocol, enabling a Safe and Secure Open Lending with core features: Cross-chain support, NFTs lending, and Liquidation coverage.

Dec 7, 2021 00:00:00

Dec 7, 2021 23:30:00

ICO Details

Ticker Symbol:

RIFI

Blockchain Network:

Binance Smart Chain

Token Type:

BEP20

Category:

Tokens for Sale:

6,000,000 RIFI

ICO Token Sale Price:

1 RIFI = 0.1 USD

Accept Payments:

USDT

Launchpad:

Huobi Primelist, RedKite

Can't participate:

Canada, China, Crimea Region, Cuba, Hong Kong, Iran, Japan, North Korea, Singapore, Sudan, Syria, Usa, Venezuela

Token Sale Page:

Rating:

Total Supply:

500,000,000 RIFI

Initial Circulating Supply:

23,600,000 RIFI

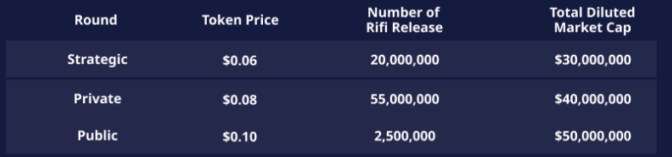

Initial Fully Diluted Market Cap:

$50,000,000

Initial Market Cap:

$2,360,000

Strategic Sale:

20,000,000 RIFI

Private Sale:

55,000,000 RIFI

Public Sale 1:

5,000,000 RIFI

Public Sale 2:

1,000,000 RIFI

Foundation:

125,000,000 RIFI

Team:

60,000,000 RIFI

Ecosystem:

40,000,000 RIFI

Liquidity:

150,000,000 RIFI

Marketing:

44,000,000 RIFI

Strategic Sale 4.00%

Private Sale 11.00%

Public Sale 1 1.00%

Public Sale 2 0.20%

Foundation 25.00%

Team 12.00%

Ecosystem 8.00%

Liquidity 30.00%

Marketing 8.80%

Strategic Sale Price:

0.06 USD

Private Sale Price:

0.08 USD

Public Sale 1 Price:

0.1 USD

Public Sale 2 Price:

0.1 USD

What Is Rikkei Finance ?

Rikkei Finance is a Metaverse DeFi Protocol, enabling a Safe and Secure Open Lending with core features: Cross-chain support, NFTs lending, and Liquidation coverage.

Rikkei Finance Unique Features

- Rikkei Finance applies multiple methods to ensure system sustainability. Rikkei Finance employs Multi-kinked interest rate model to minimize any risks related to price correction condition. Our 5-phase asset selection process using a self-developed Liquidity Ranking System also ensures that only the most liquid assets are allocated to the pool, eliminating the risk of market manipulation. Most importantly, we implements a high-standard risk management model, allowing our system to sustainably respond to any market situations.

- RiFi is a secure system that will be user-centric, enabling you to reap the maximum returns when participating in our protocol by applying a safe positive-yield interest rate model. Additionally, Rikkei Finance will collaborate closely with the insurance protocol to give you the first-ever liquidation coverage, protecting you against smart contract hacks and asset liquidation.

- RiFi is designed for easy integration into various systems, ranging from financial management platforms, such as cold wallets or gnosis safe, to NFTs marketplace systems and even insurance protocols.

- Rikkei Finance will continue to enhance and pioneer in supporting different types of collaterals, BSC assets, multi-chain assets, token-based collateral, and most especially NFTs and LP tokens.

Roadmap

Rikkei Finance Token Economy

- Payment: Limited features and/or parameters of the Rikkei Finance platform as well as protocol improvements, with voting weight calculation.

- Governance: Token holders allow voting on proposals to govern the platform based on the amount of tokens Stake into the platform.

- Reward: motivate users (lenders) to play the role of liquidity providers and contribute their digital assets to the lending pool for borrowers to use, liquidity providers will be rewarded with RIFI tokens are subject to each user’s relative contribution after adjusting and modifying various parameters.

Detailed Token Metrics

Token Distribution

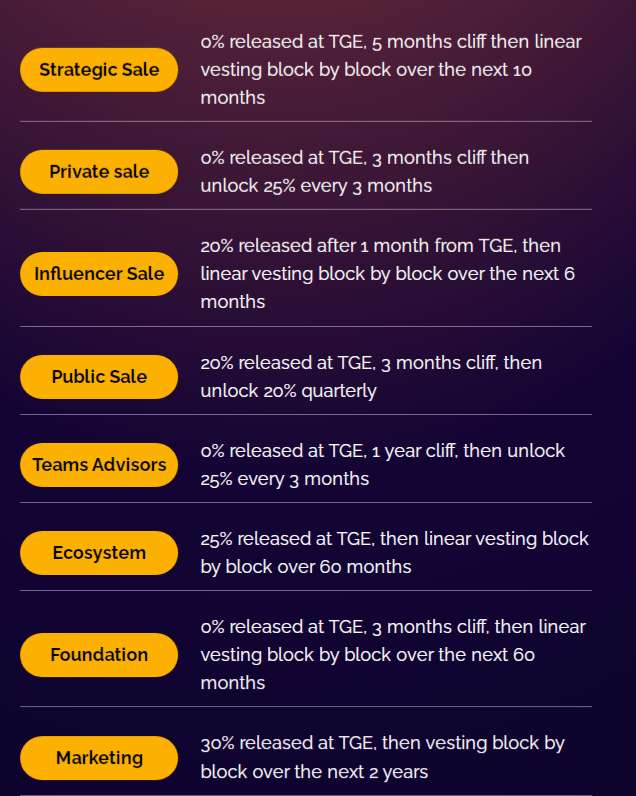

- Strategic Sale: 4%, of which 0% is distributed at TGE, tokens will be locked since in 5 months and distributed linearly by block in the next 10 months.

- Private Sale: 11%, of which 0% is distributed at TGE, tokens will be locked in the first 3 months and unlocked 25% every next 3 months.

- Public Sale: 0.5%, of which 100% will be unlocked when listing

- Marketing & listing: 4.5%,

- Team and Advisors: 12%, of which 0% distributed on TGE, locked for 1 year, and unlocked 25% every 3 months thereafter.

- Ecosystem: 8%, of which 25% distributed at TGE, and distributed linearly in blocks over 60 months.

- Liquidity Mining: 30%

- Established organization: 30%, Block linear distribution over 60 months.

Token Release Schedule

Partners & Advisors

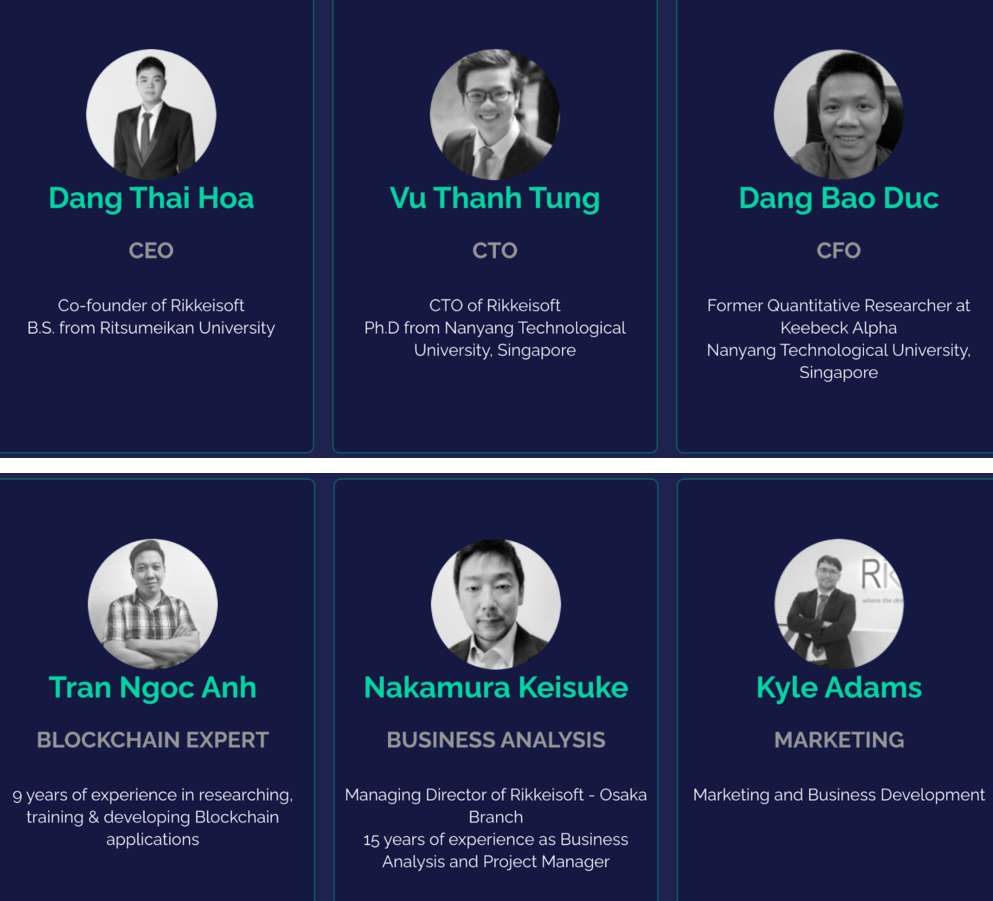

Team Members

Token Sale Pages

https://www.huobi.com/en-us/topic/primelist/?code=RIFi

https://redkite.polkafoundry.com/#/buy-token/128

Investors

Investors: LD Capital, Kyros Ventures, PNYX Ventures, Signum Capital, Inclusion Capital, Hyperchain Capital, Coin98 Ventures, Kyber Network, TomoChain, Kernel Capital, ArkStream Capital, K300 Ventures, Fomocraft Ventures, x21 Digital, YBB Foundation Limited